In crypto world we have about 10 viable projects and 9 900 shitcoins – warns Timothy F. Peterson, investment manager at Cane Island Alternative Advisors.

Piotr Rosik (deputy editor-in-chief, Strefa Inwestorów): How do You want to comment last massacre on the cryptos market?

Timothy F. Peterson (investment manager at Cane Island Alternative Advisors): In my tweets in last couple of weeks I indicated the market was severely overvalued.

LPF red trendline has marked a future bottom in 2 of 3 bubbles. Because 2013 was a manipulation it has no predictive ability. The dashed arrow at right points to #bitcoin $32,000 in 14 months. pic.twitter.com/k1GrYg2MjC

— Timothy Peterson (@nsquaredcrypto) May 2, 2021

Do You agree with the opinion of bitcoin maximalists that it is worth buying only BTC, and the rest of the cryptocurrencies are "shitcoins"?

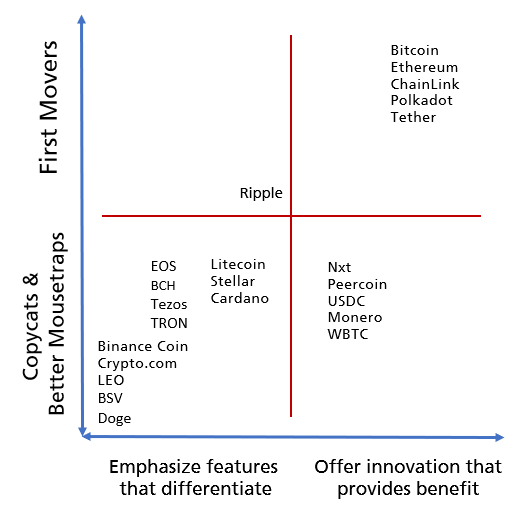

My view of the asset class is that there are innovative blockchains that solve real world problems and then there are shitcoins. Of the innovators, there are fewer than 10 first movers, and bitcoin is one of them. There are dozens of copycats. So in total, we have about 10 viable projects and 9 900 shitcoins.

Source: Cane Island Alternative Advisors

What do you think about the Dogecoin cryptocurrency, which has caused such a commotion on the cryptos market in recent months? In their report, Galaxy Digital Research experts stated that DOGE has some fundamental value, it is not a pure joke ... Will we see a shining Dogecoin star in next months?

Dogecoin started as a joke and its value, like most all cryptocoins, is in it’s acceptance. Even if it’s acceptance as a currency grows, it will not be tolerated by governments and banks if it threatens fiat. Facebook’s LIBRA project taught us this. Doge has no economic moat that will allow it to grow beyond limited use in cyberspace.

Polygon (MATIC) is also a great success in year 2021 – why?

Polygon is winning a beauty contest right now. Four months of gains is too short a period to consider something a success. I think people will be talking about something else in two years.

I know that You strongly promote the Chainlink cryptocurrency. Can you explain why? What is so unusual and unique about it?

ChainLink is the first-mover that bridges the physical world with the blockchain world. First-movers have a tremendous advantage, even over subsequent, better competitors. If you think about all of the things in the world that need to be tracked and recorded with a true and immutable record, ChainLink stands in the forefront to capture that market. What remains to be seen is if it can capture the lion’s share of the need for oracles in the physical world: energy, food, medicine, etc. If it does not, then it will wind up like MySpace or BlackBerry.

Can you imagine that some cryptocurrency will threaten the dominant position of BTC?

Possibly Ethereum but I think it will be something not invented yet.

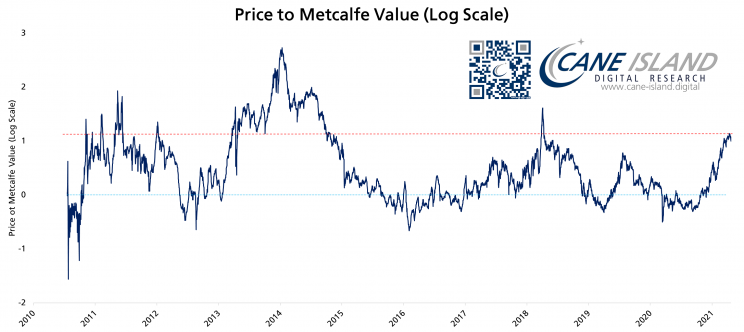

Bitcoin: price to Metcalfe value

Source: Cane Island Alternative Advisors

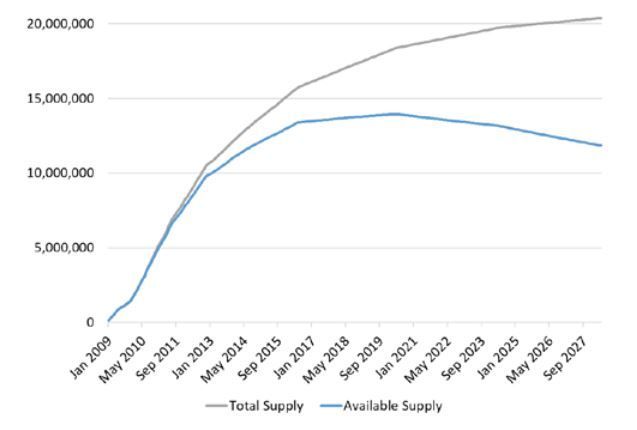

BTC supply

Source: Cane Island Alternative Advisors

Ethereum monthly returns heatmap

Source: Cane Island Alternative Advisors

How will stablecoins - like the Dai and USDT, tied to the USD rate - behave when the really high inflation in the US comes?

At some point, someone will build a structured cryptocurrency that permits a stable yield without relying on leverage, they way overcollateralized loan securities work today. Stablecoins will lose market share to these interest-bearing instruments.

How do You rate the security of stablecoins such as Dai or Tether? We recently learned about the composition of Tether (USDT) reserves. What is Your opinion on this matter? Which stablecoin is in Your opinion the safest and most attractive from the investor's point of view?

I address this issue in an upcoming article: “To the Moon: A History of Bitcoin Price Manipulation” Journal of Forensic and Investigative Accounting, Volume 13: Issue 2, July – December 2021. Please look for it in the coming months at NACVA website.

Many have already accused bitcoin of being a financial pyramid. Of course it is not. But are there any altcoins on the market that can be suspected?

Probably. I think there are 9 000 coins with a future value of 0 USD.

Coinbase recently entered the Nasdaq. Does this mean that it is the safest cryptocurrency exchange?

Not necessarily, but publicly traded companies are required to make certain disclosures and undergo a regular audit by a public accounting firm. This makes them more transparent than other exchanges.

What do you think about the concept of CBDC and can they somehow threaten the position of cryptocurrencies and bitcoin, or on the contrary - will they strengthen it?

Bitcoiners are risk-takers and independent thinkers. This is a very small subset of the global community. Most people in the world only think in terms of safety and approval. They look to government for security and friends for advice. A government-blessed coin will receive much more acceptance from people than anything else, especially in China. Bitcoin is more a threat to gold than fiat, and that may actually help bitcoin and central banks.

Do you think that any of the Big Techs may threaten the popularity of cryptocurrencies? Facebook was supposed to make its Libra cryptocurrency, but the matter died down...

The matter did not die down. Some senators went to the banking sponsors and made direct threats to the CEOs. They said: “if you continue down this path, we will investigate the hell out of you”. Big tech must now be wary of trying to compete with existing fiat or CBDC projects.

Please, indicate 5 cryptocurrencies, in addition to BTC, which are worth accumulating in the long term, let's say 5 years.

Ethereum, ChainLink, PolkaDot. I can’t even think of 5. And I would say long-term is 10-20 years not 5 years. I base my selections first on least downside risk, then most upside potential, as well as breadth of application and size of the potential user base. I am not interested in microeconomics of each token and the features that one claims to have over the other. I am a macro manager and what matters to me is broad adoption over time. To me, it is more important that you recognize when it is time to invest in televisions instead of radios, for example. That realization is much more important than trying to decide which television manufacturing company is the best investment.

How long current bull market on BTC and altcoins will last and at what levels BTC / USD will end? Will the bear market start with BTC or altcoins?

My research indicates that the cryptocurrency market is in a bubble and that this bubble is caused by leverage introduced in mid-2020. It is impossible to say how long it will last. However, I run forward-looking price simulations based on probabilities and reversion to Metcalfe Value, and the results are available for purchase at Cane Island Digital.

Timothy F. Peterson (CFA, CAIA) – Investment manager at Cane Island Alternative Advisors. One of the investment industry’s leading experts on alternative investments. He is author of popular "Metcalfe's Law as a Model for Bitcoin's Value" (Alternative Investment Analyst Review, 2018), as well as the book “Performance Measurement for Alternative Investments” (London: Risk, 2015). He has over 25 years in global investment experience and holds a M.S. Finance (honors), and B.A. Economics from the University of Colorado.